The Nominal Effective Exchange Rate (NEER) is an unadjusted weighted average rate at which the currency of one country exchanges for a basket of multiple foreign currencies. The Nominal Exchange Rate is the amount of domestic currency needed to purchase foreign currency. In simple terms, NEER is a measure of the value of a currency against a weighted average of several foreign currencies.

An Exchange Rate is the rate at which one currency will be exchanged for another currency. The Effective Exchange Rate is an index that describes the strength of a currency relative to a basket of other currencies. Effective exchange rates act as a means for assessing the fair value of a currency and the external competitiveness of an economy and as guideposts for setting financial and monetary policies.

NEER is an indicator which tells about a country’s international competitiveness in terms of the foreign exchange (forex) market. It is a form of measuring a currency’s nominal exchange rate relative to a basket of other currencies using an unadjusted weighted-average calculation. NEER, sometimes, is also known as the trade-weighted currency index.

NEER is the weighted average of bilateral nominal exchange rates of the home currency in terms of foreign currencies. Unlike the relationships in a nominal exchange rate, the NEER is not determined for each currency separately. Instead, one individual number, usually an index, demonstrates how the value of one local currency contrasts with several different foreign currencies at once.

The NEER can be adjusted to compensate for the inflation rate of the home country relative to the inflation rate of its trading partners. If a domestic currency increases against a basket of other currencies inside a floating exchange regime, NEER is said to appreciate. If the domestic currency falls against the basket, the NEER depreciates.

How to Calculate NEER?

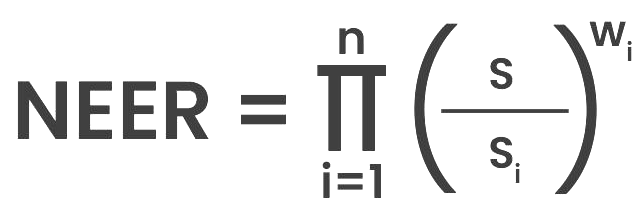

The NEER is calculated as the geometric weighted average of bilateral exchange rates of the home currency in terms of trading partner currencies. Specifically, the NEER can be calculated as follows:

- Where n = Number of currencies (other than home currency) included in the basket

- s = Exchange rate of the Indian rupee against a numeraire, i.e., the IMF’s Special Drawing Rights (SDRs) in indexed form

- si= Exchange rate of foreign currency ‘i’ against the numeraire (SDRs) (i.e., SDRs per currency i) in indexed form

- wi = Weights attached to foreign currency/country ‘i’ in the index

A rise in ‘s’ or ‘s/si’ represents an appreciation of the rupee relative to currency ‘i’ and vice versa. An increase in NEER indicates the appreciation of the rupee, whereas a decrease in its value denotes the depreciation of the rupee.

NEER compares one individual currency against a basket of foreign currencies. This basket is chosen based on the domestic country’s most important trading partners and other major currencies. The value of foreign currencies in a basket is weighted according to the value of trade with the domestic country. It could be export or import value, the total value of export and import combined, or some other measure. The weights often relate to the assets and liabilities of different countries.

A higher NEER value means that the home country’s currency is usually worth more than an imported currency, and a lower value means that the home currency is usually worth less than the imported currency. There is no international standard for choosing a basket of currencies.

The Reserve Bank of India (RBI) calculates the Nominal Effective Exchange Rate (NEER) of the rupee relative to six other currencies and 40 trading partners. The six-currency indices represent the United States, the Eurozone, the United Kingdom, Japan, China (Renminbi), and the Special Administrative Region of Hong Kong (SAR).

Reflecting India’s changing foreign trade pattern, the coverage of NEER/REER indices for the new base year, i.e., 2015-16, has been expanded from 36 to 40 currencies. The selection of currencies for the new NEER/REER series is based on two major criteria. First, trading partners with extremely high and volatile inflation are excluded as their currencies tend to experience rapid nominal declines, undermining the stability of the NEER/REER indices and obscuring their usefulness in the assessment of external competitiveness. Second, data on inflation and exchange rates of trading partners should be available on a regular basis.

Importance of NEER

- NEER is related to the currency exchange of the countries. It is mainly the amount of domestic currency which is necessary for the purchasing of foreign currency.

- NEER is considered as the weighted means of average, which is geometric in nature and related to the bilateral nominal exchange rate of the home currency to be in terms of other foreign currencies.

- NEER can also try to define the strength or weakness of the currency of a particular country with the help of a comparison of the currencies of other countries. It can indicate the international competitiveness of a particular country.

- As with all change rates, the NEER can help identify which currencies store value more or less effectively.

- NEER is used in economic studies and for policy analysis on international trade. It is also used by forex traders who engage in currency arbitrage.

Limitation of NEER

- NEER only describes the relative value; it cannot definitely show whether a currency is strong or gaining strength in real terms.

- It is a helpful tool for research, analysis, and policy-making but may not entirely drive business and investment decisions.

- It may help policymakers decide whether to intervene in the currency market or not but will not necessarily change much for those exporters, importers, and investors having an interest in one or two currencies.

Also Read: