The Real Effective Exchange Rate (REER) is the weighted average of a country’s currency in relation to an index or basket of other major currencies. The weights are determined by comparing the relative trade balance of a country’s currency against each country within the index. In simple terms, REER compares a nation’s currency value against the weighted average of the currencies of its major trading partners.

REER is the Nominal Effective Exchange Rate (NEER) adjusted by inflation differentials between the domestic currency and that of trading partners. REER reflects the inflation-adjusted value of a currency with respect to that of the trading partners. This exchange rate is used to determine an individual country’s currency value relative to the other major currencies in the index.

Real Effective Exchange Rate is the Nominal Effective Exchange Rate (a measure of the value of a currency against a weighted average of several foreign currencies) divided by a price deflator or index of costs. A nation’s Nominal Effective Exchange Rate (NEER), adjusted for inflation in the home country, equals its Real Effective Exchange Rate (REER).

REER is an indicator of the international competitiveness of a country in comparison with its trade partners. An increase in a nation’s REER implies that its exports become more expensive and its imports become cheaper. The formula is weighted to take into account the relative importance of each trading partner to the home country. Therefore, an increasing REER indicates that a country is losing in trade competitiveness.

A country’s currency may be considered undervalued, overvalued or in equilibrium with those of other nations that it trades with. A state of equilibrium means that demand and supply are equally balanced and prices will remain stable. A nation’s REER measures how well that equilibrium is being held.

How to calculate REER?

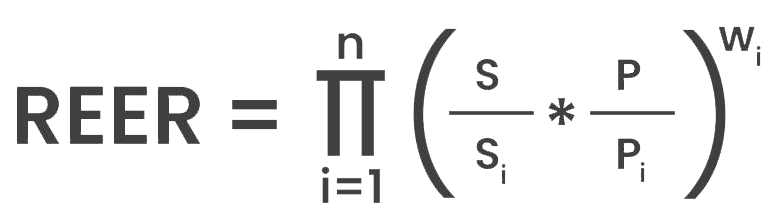

The REER, which is the NEER adjusted by the weighted average of ratio of domestic price to foreign prices, is calculated as:

- Where n = Number of currencies (other than home currency) included in the basket

- s = Exchange rate of the Indian rupee against a numeraire, i.e., the IMF’s Special Drawing Rights (SDRs) in index form

- si = Exchange rate of foreign currency ‘i’ against the numeraire (SDRs) (i.e., SDRs per currency i) in index form

- wi = trade-/export-based weight assigned to foreign currency/trading partner ‘i’ in the index

- ‘P’ and ‘Pi’ represent price indices of the home economy and the trading partner ‘i’, respectively.

- The REER of a country can be calculated by taking the average of bilateral exchange rates between itself and its trading partners and then weighing it using the trade allocation of each partner.

- The average of the exchange rates is computed after assigning the weightings for each rate. For example, if a currency weighs 60%, the exchange rate would be raised to the power of 0.60, and so on for each exchange rate and its respective weighting.

- To create the scale or index, multiply each exchange rate in step 2 by each other and multiply the final result by 100.

- Some calculations use bilateral exchange rates, while other models use real exchange rates, which adjust the exchange rate for inflation. Regardless of how REER is calculated, it is an average that is considered in equilibrium when it is overvalued in relation to one trading partner and undervalued in relation to a second partner.

The real effective exchange rate provides a composite value in the form of the exchange rate of a country’s currency in relation to its trading partners, which is adjusted for relative price movements. The movement in REER over a period of time shows changes in a country’s trade competitiveness with regard to its trading partners. An increasing REER of a country indicates a rise in the value of its currency vis-à-vis trading partners (trading partners will pay more for buying domestic goods) and thus, a loss of competitiveness. An increase in the REER implies that exports become more expensive and imports become cheaper.

As it is computed against a basket of currencies and adjusted for price differences, REER is usually less volatile than the bilateral nominal exchange rate and shows a steady pattern over the medium to long term. Nevertheless, macroeconomic and financial shocks influence short-term trends in REER.

The Reserve Bank of India (RBI) compiles and disseminates the REER of the Indian rupee for both trade and export weight. Reflecting India’s changing foreign trade pattern, the coverage of NEER/REER indices for the new base year, i.e., 2015-16, has been expanded from 36 to 40 currencies.

The selection of currencies for the new NEER/ REER series is based on two major criteria. First, trading partners with extremely high and volatile inflation are excluded as their currencies tend to experience rapid nominal declines, undermining the stability of the NEER/REER indices and obscuring their usefulness in the assessment of external competitiveness. Second, data on inflation and exchange rates of trading partners should be available on a regular basis.

Importance of REER

Real Effective Exchange Rate (REER) captures the exchange rate with a greater degree of accuracy as compared to the nominal effective exchange rate (NEER), as it also takes into account the domestic inflation in various economies.

REER is described as a procedure that can weigh a country’s average currency. The weights are determined by the comparison of the relative trade balance and the currency of the country. REER is related to the nation’s inflation rate.

The REER is an indicator of the overall external competitiveness of a country in comparison with its trade partners. An increasing REER indicates that a country is losing its competitive edge. An increase in the REER of a country implies that its exports become more expensive and its imports become cheaper.

An increasing trend in the real exchange rate decreases the cost of imported capital goods and enhances the capital-labour ratio, thereby boosting technical progress and productivity.

Appreciation of the real exchange rate can also lead to a rise in real wages, thereby increasing labour productivity in a country where the wages of unskilled labourers are generally low. Furthermore, the increase in the real exchange rate can also boost foreign competition, thereby leading to a rise in the technical efficiency and productivity of businesses.

Limitation of REER

Other than trade and commerce, other factors can also affect the REER. The REER does not account for price fluctuations, tariffs, or other elements that may affect trade between nations.

If prices are higher in one country in comparison to another, the trade might decline in the country with higher prices, impacting its REER. The weighting used in the REER computation then has to be adjusted to reflect any changes in trade.

In addition, the Central Bank of each country modifies its monetary policies, which can change the interest rates in the home country. The flow of money could increase to countries with higher rates as investors chase yield, thus strengthening the currency exchange rate. The REER would be impacted, but it would have little to do with trade and more to do with the interest rate markets.

Also Read: